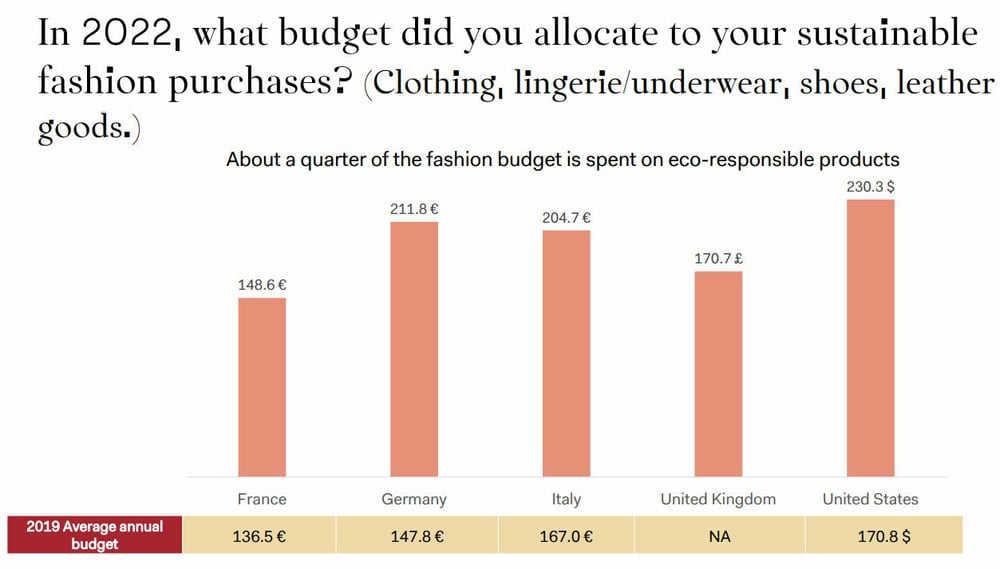

With The Rise of Sustainable Fashion What Shoppers Are Buying in 2025 at the forefront, we’re diving into a transformative era where eco-conscious choices are reshaping the fashion landscape. As sustainability takes center stage, consumers are increasingly prioritizing ethical brands that resonate with their values. This shift not only reflects a growing awareness of environmental issues but also signifies a cultural movement towards responsible consumption.

In this exploration, we will uncover the trends driving shoppers’ decisions, from materials to production practices, and how these choices are influencing the retail market. It’s a fascinating journey that highlights the innovative ways brands are adapting to meet the demands of today’s discerning consumers.

Welcome to the fascinating world of personal finance! In today’s article, we will explore essential strategies and tips that can help you take control of your finances. Whether you’re a recent graduate, a young professional, or someone looking to reevaluate your financial health, this guide aims to provide you with the knowledge needed to make informed financial decisions. ### Understanding Your Financial SituationBefore embarking on any financial journey, it is crucial to have a clear understanding of your current financial situation.

Start by calculating your net worth, which is the difference between your assets (what you own) and liabilities (what you owe). This calculation will give you a snapshot of your financial health. Next, take a close look at your income and expenses. Track your spending for a month to identify where your money is going. Categorizing your expenses into fixed (rent, utilities) and variable (entertainment, dining out) will help you see where you can cut back.### Setting Financial GoalsWith a clear picture of your financial situation, it’s time to set some goals.

Having specific, measurable, achievable, relevant, and time-bound (SMART) goals will provide you with direction. For instance, you might set a goal to save $5,000 for an emergency fund within the next 12 months. This goal is specific (saving), measurable ($5,000), achievable (depending on your income), relevant (increasing financial security), and time-bound (12 months). ### Budgeting WiselyCreating a budget is one of the most effective ways to gain control over your finances.

A budget acts as a financial roadmap, guiding your spending decisions. Begin by using the 50/30/20 rule as a framework: allocate 50% of your income to needs (housing, food, transport), 30% to wants (entertainment, travel), and 20% to savings and debt repayment. However, feel free to adjust these percentages according to your personal circumstances. The key is to ensure that your budget reflects your priorities and helps you reach your financial goals.### Saving SmartlyOnce you have a budget in place, it’s important to focus on saving.

Establishing a savings habit can be transformative. Here are a few strategies:

1. Automate Your Savings

Set up automatic transfers from your checking account to your savings account each month. Automating your savings makes it easier to reach your goals without having to think about it.

2. Emergency Fund

Aim to save three to six months’ worth of living expenses in an easily accessible account. This fund will provide a financial cushion in case of unexpected expenses, such as medical emergencies or job loss.

3. High-Interest Savings Accounts

Look for high-yield savings accounts that offer better interest rates than traditional savings accounts. This way, your savings will grow while remaining accessible.### Understanding DebtDebt can be a double-edged sword. While it can help you make significant purchases (like a home or education), it can also lead to financial stress if not managed properly. If you have existing debt, prioritize paying off high-interest debts first, such as credit cards.

Consider using the avalanche method (paying off the highest-interest debt first) or the snowball method (paying off the smallest debts first) to tackle your debt effectively. Additionally, avoid accumulating new debt by making informed purchasing decisions. Before making a purchase, ask yourself if it aligns with your financial goals.### Investing for the FutureOnce you’ve established a solid financial foundation, consider investing to grow your wealth.

Investing can seem daunting, but it’s essential for long-term financial security.

1. Start Early

The earlier you start investing, the more time your money has to grow through compound interest. Even small contributions can add up over time.

2. Diversify Your Portfolio

Don’t put all your eggs in one basket. Spread your investments across various assets (stocks, bonds, real estate) to minimize risk.

3. Research and Education

Take time to learn about different investment options. Consider reading books, attending workshops, and following reputable financial news sources to enhance your knowledge.### Retirement PlanningIt’s never too early to start thinking about retirement. The earlier you begin saving for retirement, the more likely you are to reach your desired lifestyle in your golden years.

1. Employer-Sponsored Plans

If your employer offers a retirement plan like a 401(k), take advantage of it, especially if they match contributions. This is essentially free money!

2. Individual Retirement Accounts (IRAs)

Consider opening a traditional or Roth IRA to further bolster your retirement savings. These accounts offer tax advantages that can enhance your long-term savings.

3. Regular Contributions

Make it a habit to contribute regularly to your retirement accounts, adjusting the amount as your income grows. ### Staying Financially EducatedPersonal finance is an ever-evolving field. New tools, resources, and strategies emerge frequently, so it’s essential to stay informed.

1. Read Books and Blogs

There is a wealth of information available in the form of personal finance books and blogs. Look for reputable sources that resonate with your financial philosophy.

2. Podcasts and Webinars

Engage with podcasts and webinars that cover various financial topics. These can be great for learning on the go.

3. Join Financial Communities

Sustainable Fashion Consider joining forums or local groups where you can discuss financial topics with like-minded individuals. Sharing experiences can provide valuable insights.### ConclusionTaking control of your finances is a journey that requires patience, discipline, and ongoing education. By understanding your financial situation, setting clear goals, budgeting wisely, saving smartly, managing debt, investing for the future, planning for retirement, and staying educated, you can pave the way for a secure financial future.

Remember, every small step you take today can have a significant impact tomorrow. So, start implementing these strategies today and watch your financial confidence grow!